Wedging Up For Another New High Close

Thursday, April 22, 2010 CANSLIM.net

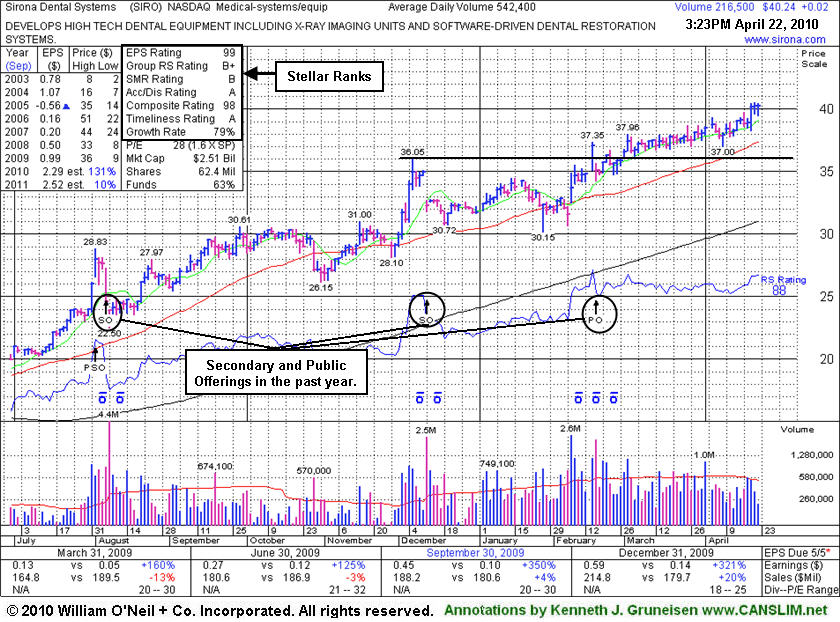

Sirona Dental Systems (SIRO +$0.20 or +0.50% to $40.42) has been wedging continually higher in recent weeks, and today it inched up for yet another new high close. It is not near a sound base now, and the company is scheduled to report results for the latests quarter before the market opens on May 5th. Prior chart highs and its 50-day moving average (DMA) line in the $36 area define important support to watch. It was featured in yellow in the 2/16/10 mid-day report (read here) as it broke out from a 10-week flat base.

Fundamentally, following 3 negative comparisons, its sales revenues in the Sep and Dec '09 quarters showed a return to growth. Quarterly earnings increases have been very strong along with great annual earnings growth in recent years (good C and A criteria). As it has rallied from January 2009 lows near $10, clearly it has been able to get help from underwriters as this high-ranked Medical - Systems/Equipment firm completed Secondary Offerings on 8/06/09 and 12/11/09, and yet another Public Offering on 2/17/10. The number of top-rated funds owning its shares rose from 55 in Mar '09 to 94 in Mar '10, which is nice reassurance with respect to the I criteria of the investment system. Companies often attract new institutional investors with the help of underwriters, but offerings often have the near-term effect of hindering upward price progress. Company management reportedly still owns a 70% interest in the company's shares even after those offerings, keeping them very motivated to maintain and build shareholder value.