You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Wednesday, April 16, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, AUGUST 26TH, 2011

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+134.72 |

11,284.54 |

+1.21% |

|

Volume |

1,119,400,920 |

-7% |

|

Volume |

1,817,862,120 |

+3% |

|

NASDAQ |

+60.22 |

2,479.85 |

+2.49% |

|

Advancers |

2,531 |

81% |

|

Advancers |

2,013 |

76% |

|

S&P 500 |

+17.53 |

1,176.80 |

+1.51% |

|

Decliners |

505 |

16% |

|

Decliners |

548 |

21% |

|

Russell 2000 |

+17.37 |

691.79 |

+2.58% |

|

52 Wk Highs |

13 |

|

|

52 Wk Highs |

9 |

|

|

S&P 600 |

+8.58 |

377.96 |

+2.32% |

|

52 Wk Lows |

101 |

|

|

52 Wk Lows |

106 |

|

|

|

Major Indices Post First Weekly Gains Since July

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The major averages posted their first weekly gains since July. For the week, the Dow Jones Industrial Average was up +4.3%, S&P 500 Index rose +4.7%, and Nasdaq Composite Index tallied a +5.9% gain. The indices finished Friday near their session highs with a lighter volume total reported on the NYSE and slightly higher volume reported on the Nasdaq exchange. Breadth was positive as advancers led decliners by 5-1 on the NYSE and nearly 4-1 on the Nasdaq exchange. On the NYSE and on the Nasdaq exchange new 52-week lows totals still solidly outnumbered the new 52-week highs totals. There were only 8 high-ranked companies from the CANSLIM.net Leaders List that made new 52-week highs and appeared on the CANSLIM.net BreakOuts Page, up from the prior session total of 5 stocks. Any sustainable rally requires a healthy crop of strong leaders hitting new 52-week highs, so it is of concern when leadership remains scant! There were gains for all of the 6 high-ranked leaders currently included on the Featured Stocks Page.

The initial reaction to Ben Bernanke’s speech to a Federal Reserve symposium was negative after there were no proposed new steps to boost the economy and hints Congress may have to help. Investors then focused on the Fed Chairman's prediction that economic growth will resume. Of course, more than a year ago Bernanke used the phrase "unusually uncertain" when describing the economic outlook, meanwhile the budget crisis, debt ceiling issue and credit rating downgrade from Triple A added to the uncertainty.

Wall Street has been overcoming more signs of weakness in Europe. Banks led a drop in European markets as worries over the Greek bailout continued. Meanwhile, U.S. economic data were on the disappointing side. U.S. gross domestic product grew at a 1.0% annual pace in the second quarter, down from the 1.3% growth estimated last month.

After reaching an all-time high of $1,917.90 per ounce on Tuesday, gold felt gravity's pull this week. The yellow metal lost the Midas touch, falling as much as -11%, amid speculation the U.S. central bank would give the economy a boost. While gold fell, crude oil rose ahead of the Fed meeting and concerns Hurricane Irene would disrupt supply. Despite giving back some gains ahead of the Jackson Hole confab, oil remained on track for its first weekly gain in more than a month

Volume totals may likely remain on the quiet side next week, with Hurricane Irene now headed for the north eastern US, and many traders tempted to sneak out early to their Hampton hideaways ahead of the upcoming Labor Day weekend. Next Friday’s important employment report will be closely watched, however, and expectations by Wall Street are for the August non-farm payrolls to rise by 95,000 jobs while the unemployment rate stands still at 9.1%. Ahead of the job numbers will be updates for personal spending and income, housing and manufacturing. Wednesday's release of the Fed minutes from the August meeting could provide insight into the decision to keep interest rates low until mid-2013. Investors also will look to speeches on from Fed regional presidents for additional insight into the current economic state.

Apple Inc (AAPL +2.64%) erased losses triggered by the resignation of Steve Jobs as CEO. Pandora Media (P +7.54%) shares rose after the online music company reported second-quarter sales and profit that beat analysts' estimates. Tiffany & Co (TIF +9.35%) jumped after the retailer lifted its outlook for the year and beat profit forecasts. Meanwhile, Travelers Companies Inc (TRV +0.65%), Allstate Corp (ALL +0.08%), and other insurance stocks held their ground or rebounded slightly as Hurricane Irene appeared to be weakening.

The market environment (M criteria) is currently described as "uptrend under pressure" since a distribution day occurred soon after Tuesday's follow-through day (FTD). Historically, when a distribution day occurs on the first or second day after a follow-through day, the "uptrend" reportedly has failed 95% of the time. The dearth of leadership (few stocks hitting new 52-week highs) also suggests that there may not be a healthy crop of leaders showing sufficient strength to allow the major averages to sustain a meaningful advance. The indices also remain well below their respective 200-day moving average (DMA) lines, and to be considered truly "healthy" they would need to rebound above their long-term averages.

The August 2011 issue of CANSLIM.net News is now available (click here). Links to all prior reports are available on the Premium Member Homepage.

PICTURED: The NYSE Composite Index shows lighter volume totals in the recent bounce, revealing a lack of conviction from the institutional crowd.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Tech, Healthcare, and Commodity-Linked Groups Led Gainers

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Semiconductor Index ($SOX +2.81%), Internet Index ($IIX +2.92%), Networking Index ($NWX +3.51%), and Biotechnology Index ($BTK +2.57%) posted large and unanimous gains for the tech sector. The Bank Index ($BKX +1.25%) and Broker/Dealer Index ($XBD +1.61%) provided a mildly positive influence, and the Retail Index ($RLX +2.25%) also helped boost the major averages on Friday. The Healthcare Index ($HMO +2.78%) also posted a strong gain, and commodity-linked areas were on the rise again as the Gold & Silver Index ($XAU +2.38%), Integrated Oil Index ($XOI +1.53%), and Oil Services Index ($OSX +3.00%) rallied.

Charts courtesy www.stockcharts.com

PICTURED: The Gold & Silver Index ($XAU +2.38%) closed the week well above its 50 DMA and 200 DMA lines.

| Oil Services |

$OSX |

224.72 |

+6.55 |

+3.00% |

-8.32% |

| Healthcare |

$HMO |

1,985.34 |

+53.72 |

+2.78% |

+17.34% |

| Integrated Oil |

$XOI |

1,114.49 |

+16.77 |

+1.53% |

-8.13% |

| Semiconductor |

$SOX |

345.78 |

+9.45 |

+2.81% |

-16.04% |

| Networking |

$NWX |

228.00 |

+7.73 |

+3.51% |

-18.73% |

| Internet |

$IIX |

272.39 |

+7.72 |

+2.92% |

-11.48% |

| Broker/Dealer |

$XBD |

88.29 |

+1.39 |

+1.61% |

-27.34% |

| Retail |

$RLX |

498.79 |

+10.96 |

+2.25% |

-1.89% |

| Gold & Silver |

$XAU |

215.94 |

+5.01 |

+2.38% |

-4.70% |

| Bank |

$BKX |

38.12 |

+0.47 |

+1.25% |

-26.99% |

| Biotech |

$BTK |

1,140.67 |

+28.54 |

+2.57% |

-12.10% |

|

|

|

|

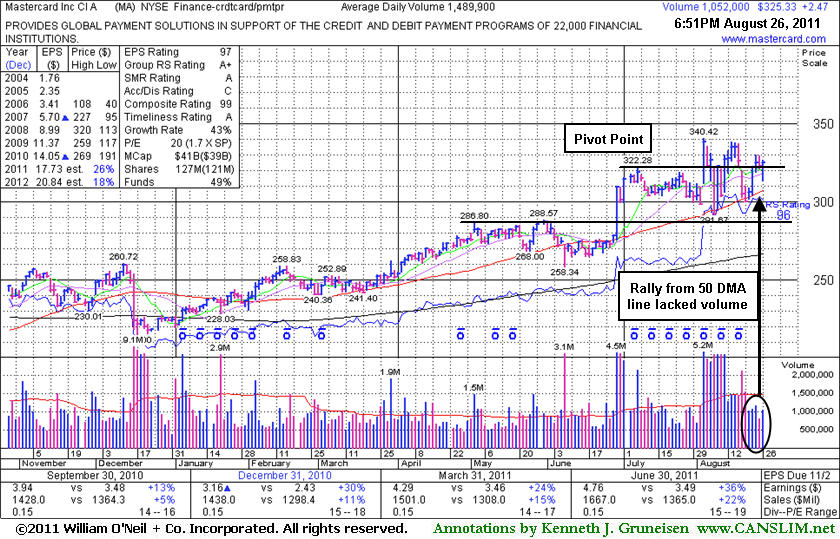

Quiet Gains Reveal Lack Of Conviction After Finding Support

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Mastercard Inc Cl A (MA +$2.47 or +0.77% to $325.33) is perched -4.4% off its 8/03/11 all-time high after gains this week on quiet volume. It recently found support near its 50-day moving average (DMA) line. Its resilience this week helped it approach its 8/03/11 all-time high and finish above the previously cited pivot point. Its last FSU appearance on 8/16/11 included an annotated weekly graph under the headline, "Weekly Chart Shows Resilience at 10-Week Average". The daily chart below shows it finding support near its 50 DMA line, but it rallied up from that important short-term average with light volume. The broader market (M criteria) confirmed a rally with a follow-through day on Tuesday this week, but the lack of leadership and fresh distributional pressure that followed may argue for caution and smart defense more than any new buying efforts.

It has been showing sales revenues acceleration and strong quarterly earnings increases, with the latest June 2011 quarter showing a +36% earnings increase on +22% sales revenues. It also has maintained a strong annual earnings (A criteria) history. A considerable 6/29/11 gain on heavy volume came after the Federal Reserve set a higher cap on debit-card fees (mentioned in the 6/29/11 Market Commentary - read here). In a handful of mid-day report appearances in June and July of this year it was noted -"It survived but failed to impress since it was dropped from the Featured Stocks list on 7/02/08 after an ominous 'double top' pattern triggered a technical sell signal." A follow-up article dated 12/16/08 had last revisited MA and summarized the action under the headline, "Multiple Sell Signals Prompted Profit Taking; Serious Damage Followed".

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

EXLS

-

NASDAQ

Exlservice Holdings Inc

DIVERSIFIED SERVICES - Business/Management Services

|

$24.70

|

+0.20

0.82% |

$24.83

|

71,143

79.22% of 50 DAV

50 DAV is 89,800

|

$26.46

-6.65%

|

8/2/2011

|

$24.85

|

PP = $24.85

|

|

MB = $26.09

|

Most Recent Note - 8/26/2011 6:37:07 PM

Most Recent Note - 8/26/2011 6:37:07 PM

Y - Consolidating near its pivot point, perched -6.7% off its 52-week high. Recent low ($23.01 on 8/19/11) and 50 DMA line define important support to watch above its 200 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/25/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

FCFS

-

NASDAQ

First Cash Financial Svs

SPECIALTY RETAIL - Specialty Retail, Other

|

$43.84

|

+0.40

0.92% |

$43.94

|

325,770

101.99% of 50 DAV

50 DAV is 319,400

|

$47.80

-8.28%

|

5/31/2011

|

$42.00

|

PP = $40.23

|

|

MB = $42.24

|

Most Recent Note - 8/26/2011 6:38:33 PM

Most Recent Note - 8/26/2011 6:38:33 PM

G - Closed near the session high after a positive reversal while again finding support near its 50 DMA line. Prior chart lows near $37-38 define support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/22/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

JCOM

-

NASDAQ

J 2 Global Communication

INTERNET - Internet Software and Services

|

$29.35

|

+0.18

0.62% |

$29.45

|

381,934

114.04% of 50 DAV

50 DAV is 334,900

|

$31.72

-7.47%

|

8/8/2011

|

$30.38

|

PP = $29.31

|

|

MB = $30.78

|

Most Recent Note - 8/26/2011 6:39:47 PM

Most Recent Note - 8/26/2011 6:39:47 PM

G - Closed near the session high today after a positive reversal. Gains this week helped it challenge its 8/03/11 high, and little resistance remains due to overhead supply.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/19/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MA

-

NYSE

Mastercard Inc Cl A

DIVERSIFIED SERVICES - Business/Management Services

|

$325.33

|

+2.47

0.77% |

$326.90

|

1,051,959

70.61% of 50 DAV

50 DAV is 1,489,900

|

$340.42

-4.43%

|

8/3/2011

|

$324.82

|

PP = $322.38

|

|

MB = $338.50

|

Most Recent Note - 8/26/2011 6:41:08 PM

Most Recent Note - 8/26/2011 6:41:08 PM

Y - Perched -4.4% off its 8/03/11 all-time high after gains this week on quiet volume. Recently found support near its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/26/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MG

-

NYSE

Mistras Group Inc

DIVERSIFIED SERVICES - Bulding and Faci;ity Management Services

|

$19.90

|

+0.57

2.95% |

$19.92

|

110,800

73.04% of 50 DAV

50 DAV is 151,700

|

$20.10

-1.00%

|

8/10/2011

|

$17.89

|

PP = $17.58

|

|

MB = $18.46

|

Most Recent Note - 8/26/2011 6:42:20 PM

Most Recent Note - 8/26/2011 6:42:20 PM

G - Finished at a new all-time high close with a gain today on light volume. No resistance remains due to overhead supply. Previous resistance in the $17-18 area defined important chart support after encountering mild distributional pressure.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/24/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

MKTX

-

NASDAQ

Marketaxess Holdings Inc

FINANCIAL SERVICES - Investment Brokerage - Nationa

|

$29.68

|

+1.17

4.10% |

$29.76

|

150,808

61.93% of 50 DAV

50 DAV is 243,500

|

$30.25

-1.88%

|

7/29/2011

|

$25.87

|

PP = $26.35

|

|

MB = $27.67

|

Most Recent Note - 8/26/2011 6:44:10 PM

Most Recent Note - 8/26/2011 6:44:10 PM

G - Finished at a new all-time high close today with a gain on light volume, extended from its prior base. Prior resistance in the $25-26 area defines chart support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/23/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|