You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Wednesday, April 16, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - WEDNESDAY, AUGUST 3RD, 2011

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+29.82 |

11,896.44 |

+0.25% |

|

Volume |

1,350,342,470 |

+8% |

|

Volume |

2,544,730,160 |

+10% |

|

NASDAQ |

+23.83 |

2,693.07 |

+0.89% |

|

Advancers |

1,705 |

55% |

|

Advancers |

1,529 |

57% |

|

S&P 500 |

+6.29 |

1,260.34 |

+0.50% |

|

Decliners |

1,315 |

42% |

|

Decliners |

1,077 |

40% |

|

Russell 2000 |

+5.78 |

772.78 |

+0.75% |

|

52 Wk Highs |

14 |

|

|

52 Wk Highs |

28 |

|

|

S&P 600 |

+2.92 |

417.68 |

+0.70% |

|

52 Wk Lows |

275 |

|

|

52 Wk Lows |

204 |

|

|

|

Major Averages Halt Losing Streak With Positive Reversals

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

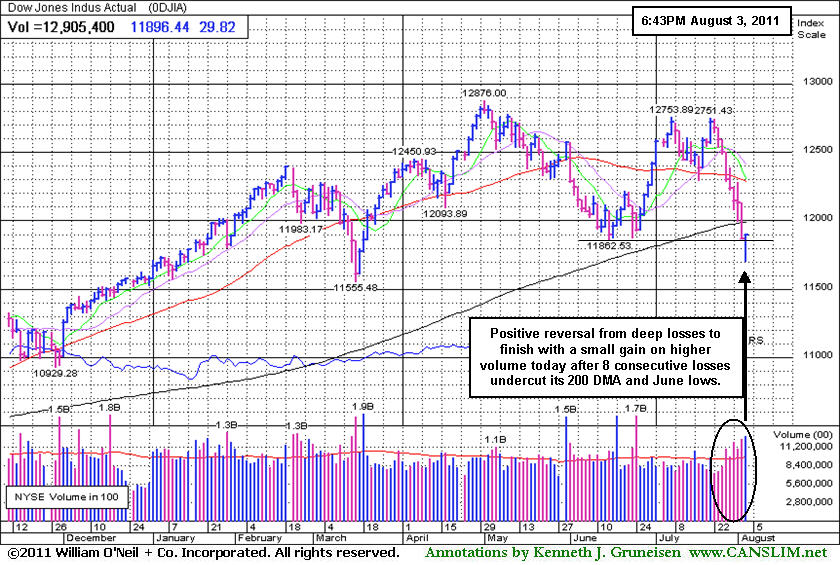

The S&P 500 Index, Dow Jones Industrial Average, and the Nasdaq Composite Index overcame deep losses and managed unanimous positive reversals on Wednesday's volatile session. The indices remain below their respective 200-day moving average (DMA) lines after a well-noted and damaging streak of losses. Fans of the fact-based investment system may recognize the major indices below their 200 DMA lines as a worrisome sign of an "unhealthy" market environment (M criteria). Volume totals were reported higher than the prior session totals on the NYSE and on the Nasdaq exchange, and the positive finish may be considered Day 1 of a new rally attempt. New 52-week lows solidly outnumbered new 52-week highs on the NYSE and on the Nasdaq exchange. Advancers led decliners by nearly 3-2 on the NYSE and on the Nasdaq exchange. There were 14 high-ranked companies from the CANSLIM.net Leaders List that made new 52-week highs and appeared on the CANSLIM.net BreakOuts Page, down from the prior total of 15 stocks. There were 14 gainers out of the 17 high-ranked leaders currently included on the Featured Stocks Page.

Traders may have been ready for some bargain-hunting after extremely nervous early trading pushed the S&P 500 Index to its lowest level of the year. Suggestions the Fed may consider a new round of economic stimulus supposed helped the market respond favorably. The ISM non-manufacturing index, a reading of the services sector, dropped in July to its lowest level since February 2010. Also, ADP Employer Services said U.S. job additions in July were slightly better than analysts expected, but the numbers did not indicate major improvement.

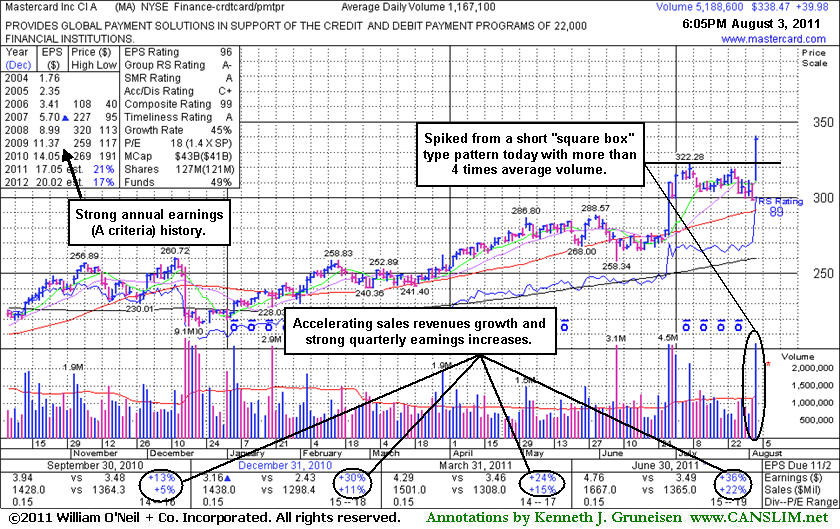

Gold prices hit yet another record high, meanwhile crude oil sank to a 5-week low below $92 per barrel in response to the weak economic data and an increase in U.S. stockpiles. Technology stocks helped lead the market's comeback, while energy stocks lagged. Research in Motion Ltd (RIMM) +4.9%) rallied as the company overhauled the Blackberry and announced three new models. MasterCard (MA +13.4%) spiked to a new high after second quarter profit beat analyst estimates. The strong outlier has an impressive earnings track record and returned to the Featured Stocks list after highlighted in the mid-day report.

The current market correction leaves disciplined investors in a defensive stance, looking toward protecting capital rather than adding more market exposure. A new rally confirmed by a solid follow-through day would be an important reassurance worth waiting for before new buying efforts may be justified.

The August 2011 issue of CANSLIM.net News will be published soon! Links to all prior reports are available on the Premium Member Homepage.

PICTURED: The Dow Jones Industrial Average managed a positive reversal from deep losses to finish with a small gain on higher volume after 8 consecutive losses undercut its 200 DMA and June lows.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Retail Index Makes Stand at 200-Day Average; Tech Groups Rise

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The tech sector underpinned the major averages gains with the Semiconductor Index ($SOX +1.12%), Internet Index ($IIX +1.28%), and Networking Index ($NWX +1.97%) rising. The Gold & Silver Index ($XAU +0.75%) edged higher. The Retail Index ($RLX +0.36%) finished with a small gain and the Bank Index ($BKX +0.61%) and Broker/Dealer Index ($XBD +0.80%) also had a positive influence as they posted small gains. The Integrated Oil Index ($XOI -0.91%) and Oil Services Index ($OSX -0.70%) ended with modest losses. The Biotechnology Index ($BTK -0.61%) also finished lower while the Healthcare Index ($HMO +0.09%) held its ground.

Charts courtesy www.stockcharts.com

PICTURED: The Retail Index ($RLX +0.36%) finished above its 200-day moving average (DMA) line after trading below it intra-day.

| Oil Services |

$OSX |

261.74 |

-1.84 |

-0.70% |

+6.78% |

| Healthcare |

$HMO |

2,043.61 |

+1.82 |

+0.09% |

+20.78% |

| Integrated Oil |

$XOI |

1,235.44 |

-11.32 |

-0.91% |

+1.84% |

| Semiconductor |

$SOX |

379.39 |

+4.22 |

+1.12% |

-7.87% |

| Networking |

$NWX |

253.44 |

+4.89 |

+1.97% |

-9.67% |

| Internet |

$IIX |

298.73 |

+3.79 |

+1.28% |

-2.92% |

| Broker/Dealer |

$XBD |

102.70 |

+0.82 |

+0.80% |

-15.49% |

| Retail |

$RLX |

515.72 |

+1.83 |

+0.36% |

+1.44% |

| Gold & Silver |

$XAU |

209.80 |

+1.57 |

+0.75% |

-7.41% |

| Bank |

$BKX |

44.71 |

+0.27 |

+0.61% |

-14.37% |

| Biotech |

$BTK |

1,280.79 |

-7.92 |

-0.61% |

-1.30% |

|

|

|

|

Surge To New Highs Makes Mastercard an Outlier to Watch

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Mastercard Inc Cl A (MA +$39.98 or +13.39% to $338.47) gapped up today and hit a new all-time high after a 4-week consolidation that may be considered a "square box" base. It has been showing sales revenues acceleration and strong quarterly earnings increases, with the latest June 2011 quarter showing a +36% earnings increase on +22% sales revenues. It also has maintained a strong annual earnings (A criteria) history. Its color code was changed to yellow with a pivot point cited based on its prior high plus 10 cents. It held its ground well above prior highs and its 50-day moving average (DMA) line since the considerable 6/29/11 gain on heavy volume after the Federal Reserve set a higher cap on debit-card fees (mentioned in the 6/29/11 Market Commentary - read here). In a handful of mid-day report appearances in June and July of this year it was noted -"It survived but failed to impress since it was dropped from the Featured Stocks list on 7/02/08 after an ominous 'double top' pattern triggered a technical sell signal." A follow-up article dated 12/16/08 had last revisited MA and summarized the action under the headline, "Multiple Sell Signals Prompted Profit Taking; Serious Damage Followed".

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ATHN

-

NASDAQ

Athenahealth Inc

DIVERSIFIED SERVICES - Business/Management Services

|

$60.00

|

+0.57

0.96% |

$60.72

|

760,355

148.86% of 50 DAV

50 DAV is 510,800

|

$61.78

-2.88%

|

7/22/2011

|

$57.30

|

PP = $50.66

|

|

MB = $53.19

|

Most Recent Note - 8/2/2011 12:14:22 PM

G - Up today, inching to another new all-time high, getting extended from prior highs in the $50 area that define support after its 7/22/11 breakaway gap.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/27/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

BIDU

-

NASDAQ

Baidu Inc Ads

INTERNET - Internet Information Providers

|

$152.43

|

-0.49

-0.32% |

$155.00

|

11,447,847

126.71% of 50 DAV

50 DAV is 9,034,600

|

$165.96

-8.15%

|

7/26/2011

|

$164.32

|

PP = $156.14

|

|

MB = $163.95

|

Most Recent Note - 8/2/2011 4:26:48 PM

Y - Dipped further below its pivot point today. No resistance remains due to overhead supply after the 7/25/11 "breakaway gap" triggered a technical buy signal, but any subsequent close below its old high close ($152.37 on 4/16/11) would completely negate the breakout and raise more concerns. Weak market (M criteria) environment is currently a concern, since 3 out of 4 stocks tend to go in the direction of the major averages.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/28/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CACC

-

NASDAQ

Credit Acceptance Corp

FINANCIAL SERVICES - Credit Services

|

$75.67

|

-3.09

-3.92% |

$77.37

|

72,221

189.56% of 50 DAV

50 DAV is 38,100

|

$86.87

-12.89%

|

6/2/2011

|

$76.10

|

PP = $82.39

|

|

MB = $86.51

|

Most Recent Note - 8/3/2011 7:46:07 PM

Most Recent Note - 8/3/2011 7:46:07 PM

G - Gapped down today for another damaging loss on heavy volume, violating the prior chart lows in the $75 area noted as important support, raising more serious concerns. Reported earnings +37% on +16% sales revenues for the quarter ended June 30, 2011 versus the year ago period.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/27/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

EXLS

-

NASDAQ

Exlservice Holdings Inc

DIVERSIFIED SERVICES - Business/Management Services

|

$25.98

|

+1.67

6.87% |

$26.00

|

171,996

270.43% of 50 DAV

50 DAV is 63,600

|

$25.46

2.04%

|

8/2/2011

|

$24.85

|

PP = $24.85

|

|

MB = $26.09

|

Most Recent Note - 8/3/2011 7:49:46 PM

Most Recent Note - 8/3/2011 7:49:46 PM

Y - Up considerably today and it finished near the session high triggering a technical buy signal with +170% above average volume behind its gain. See the latest FSU analysis for more details and an annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/2/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

FCFS

-

NASDAQ

First Cash Financial Svs

SPECIALTY RETAIL - Specialty Retail, Other

|

$44.41

|

+0.07

0.16% |

$45.68

|

320,603

147.81% of 50 DAV

50 DAV is 216,900

|

$46.42

-4.33%

|

5/31/2011

|

$42.00

|

PP = $40.23

|

|

MB = $42.24

|

Most Recent Note - 8/3/2011 12:01:06 PM

Most Recent Note - 8/3/2011 12:01:06 PM

G - Churning heavy volume without making meaningful price progress, a sign of distributional pressure. Extended from its prior base, meanwhile recent chart lows and its 50 DMA line define important near-term support to watch in the $41 area.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/18/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

FOSL

-

NASDAQ

Fossil Inc

CONSUMER DURABLES - Recreational Goods, Other

|

$123.57

|

+1.36

1.11% |

$123.92

|

1,166,205

165.04% of 50 DAV

50 DAV is 706,600

|

$134.98

-8.45%

|

2/1/2011

|

$73.30

|

PP = $74.44

|

|

MB = $78.16

|

Most Recent Note - 8/2/2011 4:31:37 PM

G - Closed near the session low today with a loss on average volume. Retreating from all-time highs and slumping toward its 50 DMA line defining important support.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/21/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

LULU

-

NASDAQ

Lululemon Athletica

MANUFACTURING - Textile Manufacturing

|

$60.47

|

+1.18

1.99% |

$60.49

|

3,060,974

73.68% of 50 DAV

50 DAV is 4,154,600

|

$64.49

-6.23%

|

6/21/2011

|

$51.48

|

PP = $50.57

|

|

MB = $53.10

|

Most Recent Note - 8/2/2011 6:11:34 PM

G - Closed near the session low with a loss today on higher but below average volume. It is -8.1% off its all-time high with volume totals generally cooling in recent weeks while extended from a sound base. Its 50 DMA line and prior resistance defining support to watch. A 2:1 split effective 7/12/11 impacted prices (prior Featured Price, Pivot Point, and Max Buy levels were adjusted).

>>> The latest Featured Stock Update with an annotated graph appeared on 7/15/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MA

-

NYSE

Mastercard Inc Cl A

DIVERSIFIED SERVICES - Business/Management Services

|

$338.47

|

+39.98

13.39% |

$340.42

|

5,191,293

444.80% of 50 DAV

50 DAV is 1,167,100

|

$322.28

5.02%

|

8/3/2011

|

$324.82

|

PP = $322.38

|

|

MB = $338.50

|

Most Recent Note - 8/3/2011 7:54:45 PM

Most Recent Note - 8/3/2011 7:54:45 PM

Y - Gapped up today and hit a new all-time high after a 4 week consolidation that may be considered a square box base. Color code was changed to yellow with pivot point cited based on its high plus 10 cents in the mid-day report, and its strong finish left it near its "max buy" level after trigging a technical buy signal. The M criteria remains an overriding concern for disciplined investors, and its negative stance argues against any new buying efforts until a confirmed uptrend in the major averages resumes. See the latest FSU analysis for more details and an annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/3/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MKTX

-

NASDAQ

Marketaxess Holdings Inc

FINANCIAL SERVICES - Investment Brokerage - Nationa

|

$27.08

|

+0.83

3.16% |

$27.13

|

205,184

125.73% of 50 DAV

50 DAV is 163,200

|

$27.00

0.30%

|

7/29/2011

|

$25.87

|

PP = $26.35

|

|

MB = $27.67

|

Most Recent Note - 8/3/2011 7:35:54 PM

Most Recent Note - 8/3/2011 7:35:54 PM

Y - Posted a solid gain today for a new high with only +25% above average volume, below the volume threshold for a proper technical buy signal.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/29/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MWIV

-

NASDAQ

M W I Veterinary Supply

HEALTH SERVICES - Medical Instruments and; Supplies

|

$85.29

|

-0.60

-0.70% |

$86.00

|

90,467

142.02% of 50 DAV

50 DAV is 63,700

|

$90.24

-5.49%

|

7/11/2011

|

$83.39

|

PP = $84.67

|

|

MB = $88.90

|

Most Recent Note - 8/3/2011 7:36:51 PM

Most Recent Note - 8/3/2011 7:36:51 PM

G - Down today on above average volume. Its 7/29/11 gain was backed by only +26% above average volume, below the threshold to trigger a proper technical buy signal. Reported earnings +23% on +18% sales revenues for the quarter ended June 30, 2011 versus the year ago period. That marks the weakest sales and earnings increases in the span of 6 quarterly comparisons, raising concerns. The sub par earnings increase (below the +25% guideline) coupled with broader market (M criteria) weakness may give investors reasons to avoid new buying efforts.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/30/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

OTEX

-

NASDAQ

Open Text Corp

INTERNET - Internet Software and Services

|

$63.36

|

+0.75

1.20% |

$63.65

|

309,000

109.54% of 50 DAV

50 DAV is 282,100

|

$72.32

-12.39%

|

6/1/2011

|

$65.86

|

PP = $67.18

|

|

MB = $70.54

|

Most Recent Note - 8/3/2011 7:38:47 PM

Most Recent Note - 8/3/2011 7:38:47 PM

G - Today it managed a positive reversal. Violated support at old highs near $66 and slumped under its 50 DMA line on the prior session with a damaging loss on above average volume, triggering a technical sell signal. A prompt rally above its 50 DMA would helped its outlook, technically.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/20/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

PCLN

-

NASDAQ

Priceline.Com Inc

INTERNET - Internet Software and Services

|

$521.97

|

+3.65

0.70% |

$525.39

|

1,203,155

124.77% of 50 DAV

50 DAV is 964,300

|

$561.88

-7.10%

|

7/29/2011

|

$539.46

|

PP = $552.15

|

|

MB = $579.76

|

Most Recent Note - 8/3/2011 7:41:54 PM

Most Recent Note - 8/3/2011 7:41:54 PM

Y - Positive reversal today after dipping below its 50 DMA line. Finished -7.1% off its 52-week high. Due to reporting earnings. A subsequent breakout could trigger a technical buy signal, but keep in mind that the M criteria may override all other promising criteria, since 3 out of 4 stocks follow the direction of the major averages. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/1/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

PRGO

-

NASDAQ

Perrigo Co

DRUGS - Drug Related Products

|

$87.98

|

+2.18

2.54% |

$88.35

|

1,488,787

329.01% of 50 DAV

50 DAV is 452,500

|

$94.61

-7.01%

|

7/13/2011

|

$92.89

|

PP = $92.40

|

|

MB = $97.02

|

Most Recent Note - 8/3/2011 7:43:54 PM

Most Recent Note - 8/3/2011 7:43:54 PM

G - Positive reversal today for a volume-driven gain, repairing its 50 DMA violation promptly after a streak of 5 consecutive damaging losses triggered a technical sell signal and raised more serious concerns. Color code was changed to green due to weak action after this riskier late-stage setup stalled following a rally to new 52-week highs.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/13/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

PSMT

-

NASDAQ

Pricesmart Inc

RETAIL - Drug Stores

|

$61.54

|

+3.44

5.92% |

$62.25

|

321,745

140.75% of 50 DAV

50 DAV is 228,600

|

$62.27

-1.17%

|

7/22/2011

|

$60.04

|

PP = $61.14

|

|

MB = $64.20

|

Most Recent Note - 8/3/2011 7:31:36 PM

Most Recent Note - 8/3/2011 7:31:36 PM

Y - Rallied with +40% above average volume today for a gain and closed above its pivot point, meeting the minimum volume guideline for a buy signal. However, the negative bias in the broader market (M criteria) argues against new buying efforts for the near-term until a confirmation day occurs.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/22/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

QSII

-

NASDAQ

Quality Systems Inc

COMPUTER SOFTWARE and SERVICES - Healthcare Information Service

|

$89.37

|

+0.87

0.98% |

$89.81

|

332,416

131.39% of 50 DAV

50 DAV is 253,000

|

$93.64

-4.56%

|

7/6/2011

|

$91.26

|

PP = $91.67

|

|

MB = $96.25

|

Most Recent Note - 8/2/2011 4:19:20 PM

Y - Reversed into the red again today after early gains had it poised for a best-ever close. Reported earnings +55% on +21% sales revenues for the quarter ended June 30, 2011 versus the year ago period. Volume-driven gains and a strong finish for new highs with heavy volume would be a technical buy signal, however the weaker market action (M criteria) of late is arguing against any new buying efforts.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/6/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$62.08

|

+0.65

1.06% |

$62.72

|

891,535

96.07% of 50 DAV

50 DAV is 928,000

|

$68.80

-9.77%

|

1/6/2011

|

$36.12

|

PP = $37.34

|

|

MB = $39.21

|

Most Recent Note - 8/2/2011 6:27:30 PM

G - Closed near the session low today, consolidating near support at its 50 DMA line. It rallied +200% since first featured in yellow at $22.81 in the 3/12/10 mid-day report.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/14/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ZAGG

-

NASDAQ

Zagg Inc

SPECIALTY RETAIL - Specialty Retail, Other

|

$16.62

|

+0.52

3.23% |

$16.69

|

1,444,618

58.89% of 50 DAV

50 DAV is 2,453,000

|

$16.90

-1.66%

|

6/1/2011

|

$10.92

|

PP = $10.59

|

|

MB = $11.12

|

Most Recent Note - 8/3/2011 7:33:25 PM

Most Recent Note - 8/3/2011 7:33:25 PM

G - Up today for its best ever close with a small gain on below average volume. Extended from a sound base. No overhead supply remains to act as resistance. Its 50 DMA line and recent lows define chart support.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/19/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|