You are not logged in.

This means

you CAN ONLY VIEW reports that were published prior to Wednesday, April 16, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

MIDDAY BREAKOUTS REPORT - THURSDAY, AUGUST 11TH, 2011 MIDDAY BREAKOUTS REPORT - THURSDAY, AUGUST 11TH, 2011

Previous Mid Day Report Next Mid Day Report >>>

|

|

DOW 10981.61 261.67 (2.44%) | NASDAQ 2461.02 79.97 (3.36%) | S&P 500 1151.33 30.57 (2.73%)

|

Time of Screening :

8/11/2011 12:11:12 PM Report Released :

8/11/2011 12:51:37 PM

Price is:

Above 52W High and Less Than 52W High

but within 7% of the 52 Week High

Volume Is:

At least 57.5% of 50 Day Average at

the time of the screening.

More details about this report...

At around

mid-way through each trading day we run

a screen against our database of

high-ranked stocks, searching for

possible buy candidates that are trading

at or near their 52-week high on above

average volume. The results of that

screen are split into the two sections

you see below. The first, titled

"TODAY's FEATURED STOCKS" shows stocks

that our experts have recently

identified as among the strongest candidates to

consider. Stocks highlighted in yellow

are the most timely and noteworthy, so

particular attention and prompt action

may be appropriate. The second section,

titled "TODAY's BREAKOUT SCREEN" shows

the remainder of stocks meeting today's

screen parameters. Our experts have

reviewed and included notes on these

stocks as well, but found that they may

not match up as favorably.

|

|

Y - Today's strongest

candidates

highlighted

by our staff

of experts.

|

|

G - Previously featured in

this report as yellow and

now may no longer be buyable

under the guidelines.

|

|

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(50 DAV) |

52 Wk Hi

% From Hi |

Date

Featured |

Price

Featured |

Pivot Point |

|

Max Buy |

FCFS

- NASDAQ

FirstCash Holdings Inc

|

$43.49

|

+1.11

2.62%

|

$43.67

|

244,295

91.50% of 50 DAV

50 DAV is 267,000

|

$46.42

-6.31%

|

5/31/2011 |

$42.00

|

PP = $40.23

MB = $42.24 |

Most Recent Note - 8/11/2011 12:28:25 PM

G - Up further today after 2 consecutive volume-driven gains helped it rally back above its 50 DMA line. The prior chart lows near $37-38 define support to watch now above its 200 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/9/2011. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

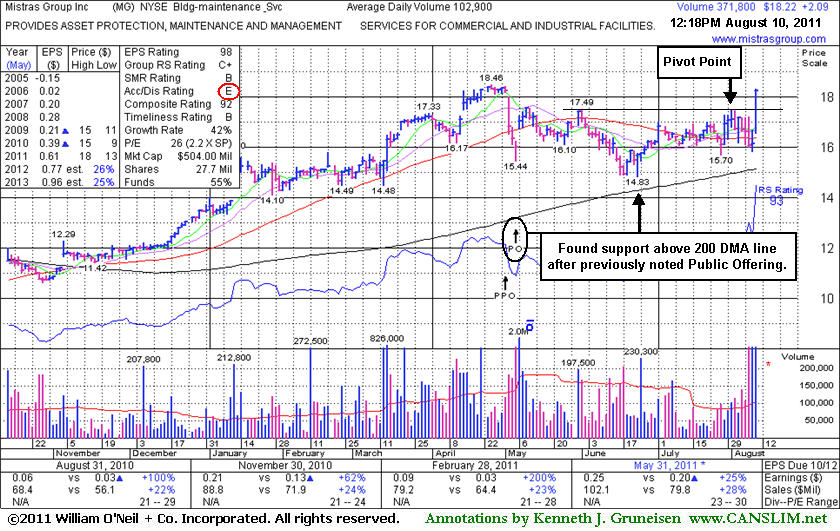

MG

- NYSE

Mistras Group Inc

|

$17.50

|

-0.19

-1.07%

|

$17.99

|

97,327

82.20% of 50 DAV

50 DAV is 118,400

|

$18.46

-5.20%

|

8/10/2011 |

$17.89

|

PP = $17.58

MB = $18.46 |

Most Recent Note - 8/11/2011 12:31:43 PM

Y - Holding its ground today after finishing the prior session above the pivot point cited in the 8/10/11 mid-day report. Its considerable gain was driven by heavy volume, rallying from a base formed since the previously noted Public Offering on 5/05/11. It found support well above its 200 DMA line after it was dropped from the Featured Stocks list on 6/14/11. It faces very little resistance due to overhead supply up to its 52-week high. Its Accumulation/Distribution rating of E (see red circle) is a concern, however the number of top-rated funds owning its shares rose from 99 in Sep '10 to 147 in Jun '11, a reassuring sign concerning the I criteria. The M criteria still argues against new buying efforts, and disciplined investors know that.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/12/2011. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

|

|

Symbol - Exchange - Industry Group

Company Name |

Last |

Chg |

Day

High |

52 WK Hi |

% From Hi |

Volume

% DAV |

DAV |

AUY

- NYSE - METALS & MINING - Gold

Yamana Gold Inc

|

$14.93 |

+0.06

0.40%

|

$14.94

|

$15.23

|

-1.97% |

8,737,085

87.33%

|

10,005,100

|

Most Recent Note for AUY - 8/11/2011 12:13:33 PM

At its 52-week high today after 4 consecutive gains driven by above average volume. Making progress above stubborn resistance in the $13 area. Quarterly sales revenues and earnings increases in the 4 latest comparisons through June 30, 2011 were well above the +25% guideline satisfying the C criteria. The downturn in FY '09 earnings is a fundamental flaw concerning the A criteria. With respect to the I criteria, the number of top rated funds owning its shares fell from 906 in Mar '11 to 860 in Jun '11. It survived but failed to impress since 4/23/2008 when it was dropped from the Featured Stocks list and subsequently fell from $13 to $3 over the next 6 months. First it had traded up as much as +25.4% after it was first featured at $15.89 in the February 2008 CANSLIM.net News (read here).

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

AZO

- NYSE - RETAIL - Auto Parts Stores

Autozone Inc

|

$281.21 |

+6.39

2.33%

|

$283.09

|

$302.00

|

-6.88% |

232,436

62.91%

|

369,500

|

Most Recent Note for AZO - 8/11/2011 12:14:12 PM

Tested support near its 200 DMA line this week. As noted in the 6/20/11 mid-day report - "Reported +28% earnings on +9% sales revenues for the quarter ended April 30, 2011. Its 4 latest quarterly comparisons (C criteria) showed earnings increases above the +25% minimum guideline while sales revenues increases were in the +1-13% range and gradually accelerating. It is heavily owned by mutual funds already, and top-rated funds owning shares fell from 1,105 in Dec '10 to 1,062 in Mar '11, not a reassuring sign concerning the I criteria. While consumers are fixing their old cars and holding off on new car purchases, AZO and similar players in the auto-repair arena have shown some leadership."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

CF

- NYSE - CHEMICALS - Agricultural Chemicals

C F Industries Holdings

|

$161.49 |

+12.30

8.25%

|

$162.92

|

$163.25

|

-1.08% |

2,484,596

97.70%

|

2,543,100

|

Most Recent Note for CF - 8/11/2011 12:20:07 PM

Gapped up today, challenging its 52-week high. Tested support at its 200 DMA line as it endured distributional pressure since last noted in the 7/12/11 mid-day report - "This high-ranked leader's earnings and sales revenues showed great increases in recent quarterly comparisons, however it lacks a good steady annual earnings growth history (the A criteria)."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

CHD

- NYSE - CONSUMER NON-DURABLES - Cleaning Products

Church & Dwight Inc

|

$40.52 |

+0.72

1.81%

|

$40.63

|

$42.84

|

-5.42% |

666,436

78.93%

|

844,300

|

Most Recent Note for CHD - 8/11/2011 12:21:48 PM

The 8/10/11 mid-day report noted - "Rallying from support at its 200 DMA line toward its its 50 DMA line which may now act as resistance. This soap maker has been considered a 'safe haven' by certain investors. Its earnings and sales growth history is below guidelines and has been previously noted as 'lackluster'."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

EGO

- NYSE - METALS & MINING - Gold

Eldorado Gold Corp

|

$19.19 |

-0.28

-1.44%

|

$19.49

|

$20.23

|

-5.14% |

3,033,312

66.51%

|

4,560,800

|

Most Recent Note for EGO - 8/11/2011 12:23:29 PM

Paused after rallying above prior 2011 highs as the 8/10/11 mid-day report noted - "Adding to a recent spurt of volume-driven gains that are helping it approach its 2010 all-time high of $20.23. It survived but failed to impress since it was dropped from the Featured Stocks list on 8/19/10. Reported earnings +40% on +22% sales revenues for the latest quarter ended June 30, 2011, but the 3 prior quarterly comparisons showed earnings increases below the +25% guideline concerning the C criteria."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

EPD

- NYSE - ENERGY - Independent Oil & Gas

Enterprise Products Ptnr

|

$42.96 |

+0.90

2.14%

|

$43.17

|

$44.35

|

-3.14% |

1,120,724

87.87%

|

1,275,500

|

Most Recent Note for EPD - 8/11/2011 12:26:24 PM

Rallied back from deep below its 50 and 200 DMA lines this week. Recent quarterly comparisons showed some improvement, but as last noted in the 7/23/10 mid-day report - "Annual and quarterly earnings history are below guidelines for this MLP, like several others in the Oil and Gas - Transportation/Pipeline industry group noted in recent mid-day reports."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

MCD

- NYSE - LEISURE - Restaurants

Mcdonalds Corp

|

$85.50 |

+1.42

1.69%

|

$85.99

|

$89.57

|

-4.54% |

4,531,556

68.70%

|

6,595,700

|

Most Recent Note for MCD - 8/11/2011 12:29:11 PM

Consolidating above its 50 DMA line today with wider than usual intra-day swings in the past week that are indicative of worrisome uncertainty in the market. The global burger giant's stock is viewed as a "safe haven" and longtime favorite for some institutional investors, however, with 1.04 billion shares outstanding it is unlikely to be a sprinter capable of many-fold price increases. Earnings increases in the quarterly comparisons have not met the +25% minimum guideline, and sales revenues increases have been sub par.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

NGD

- AMEX - METALS & MINING - Gold

New Gold Inc

|

$11.63 |

-0.08

-0.68%

|

$11.72

|

$11.95

|

-2.68% |

2,721,937

85.00%

|

3,202,400

|

Most Recent Note for NGD - 8/11/2011 12:33:25 PM

Holding its ground today after 3 consecutive volume-driven gains. Perched within -2% of its 52-week high with little resistance remaining due to overhead supply. Found support near its 200 DMA during its consolidation since noted in the 3/21/11 mid-day report - "Recent quarterly comparisons show sales revenues and earnings increases but its up and down annual earnings (A criteria) history leaves fundamental concerns."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

NGLS

- NYSE - ENERGY - Oil & Gas Refining & Marketing

Targa Resources Prtnrs

|

$34.10 |

+0.48

1.43%

|

$34.33

|

$36.40

|

-6.32% |

259,178

81.04%

|

319,800

|

Most Recent Note for NGLS - 8/11/2011 12:34:52 PM

The past week included deep plunge below its 200 DMA line, then gains with lighter volume helped it rally back above that long-term average. This MLP showed big earnings in the Mar and Jun '11 quarters but its prior earnings history has been erratic and below the fact-based investment system's guidelines.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

OKS

- NYSE - ENERGY - Oil &; Gas Pipelines

Oneok Partners Lp

|

$42.60 |

+0.16

0.38%

|

$42.99

|

$44.80

|

-4.91% |

238,004

87.24%

|

272,800

|

Most Recent Note for OKS - 8/11/2011 12:37:56 PM

Rebounded from a deep plunge below its 50 and 200 DMA lines in the past week. This MLP's earnings history has been below the guidelines of the fact-based system.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

PAA

- NYSE - ENERGY - Oil & Gas Pipelines

Plains All Amer Pipe

|

$64.04 |

+1.31

2.09%

|

$64.20

|

$65.96

|

-2.91% |

377,726

84.92%

|

444,800

|

Most Recent Note for PAA - 8/11/2011 12:41:10 PM

This MLP rebounded above its 50 and 200 DMA lines this week after damaging distribution pressured it to 2011 lows. Recent quarterly comparisons show sales revenues and earnings acceleration above the +25% guideline, but annual earnings (A criteria) growth history has not been strong and steady.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

RGLD

- NASDAQ - METALS & MINING - Gold

Royal Gold Inc

|

$68.61 |

-0.17

-0.25%

|

$70.41

|

$70.86

|

-3.18% |

606,313

86.42%

|

701,600

|

Most Recent Note for RGLD - 8/11/2011 12:42:50 PM

Trading wider than usual intra-day price swings during the past week, enduring distributional pressure after recently spiking to new all-time highs. No resistance remains to hinder its progress. Prior mid-day reports noted - "Its up and down annual earnings (A criteria) history does not meet the investment system guidelines, but recent quarterly comparisons showed mostly strong sales revenues and earnings increases versus the year ago period."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

STMP

- NASDAQ - Retail-Internet

Stamps.com Inc

|

$16.64 |

-0.11

-0.66%

|

$16.99

|

$17.88

|

-6.94% |

61,358

67.72%

|

90,600

|

Most Recent Note for STMP - 8/11/2011 12:43:16 PM

Consolidating above prior highs following previously noted volume-driven gains. Its considerable breakaway gap up on 7/29/11 for a new 52-week high, technically cleared a long base pattern, and it was noted in the mid-day report - "Earnings increased by +125% on +26% sales revenues for the quarter ended June 30, 2011. Showing impressive sequential acceleration in recent quarterly comparisons, but prior quarterly comparisons showed lackluster sales revenues increases well below the +25% guideline, leaving some fundamental concerns."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

SXL

- NYSE - ENERGY - Oil & Gas Pipelines

Sunoco Logistics Ptnr Lp

|

$85.16 |

+2.01

2.42%

|

$85.43

|

$91.03

|

-6.45% |

43,465

62.00%

|

70,100

|

Most Recent Note for SXL - 8/11/2011 12:45:08 PM

This MLP rebounded above its 50 and 200 DMA lines this week after damaging distribution pressured it to 2011 lows. Quarterly and annual earnings growth (C and A criteria) have been below the fact-based investment system's guidelines.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

TNH

- NYSE - CHEMICALS - Agricultural Chemicals

Terra Nitrogen Co Lp

|

$163.28 |

+5.02

3.17%

|

$165.35

|

$167.83

|

-2.71% |

58,589

79.07%

|

74,100

|

Most Recent Note for TNH - 8/11/2011 12:46:27 PM

Perched near its 52-week high, repeatedly noted as extended from any sound base pattern, yet it found support near its 50 DMA line and well above prior chart resistance on its recent pullback. Reported earnings +78% on +19% sales revenues for the quarter ended June 30, 2011 versus the year ago period and recent quarters were strong, but its up and down annual earnings (questionable A) history remains a fundamental concern. There is a small supply of only 4.26 million shares in its float, which can contribute to greater price volatility in the event of institutional buying or selling.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

UL

- NYSE - FOOD & BEVERAGE - Food - Major Diversified

Unilever Plc

|

$31.43 |

+0.90

2.95%

|

$31.43

|

$33.40

|

-5.90% |

2,059,712

127.58%

|

1,614,500

|

Most Recent Note for UL - 8/11/2011 12:48:03 PM

Rebounding after slumping under its 200 DMA line on the prior session. Annual and quarterly earnings history have been below guidelines.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

WPZ

- NYSE - CHEMICALS - Specialty Chemicals

Williams Partners Lp

|

$53.75 |

+1.25

2.38%

|

$53.75

|

$56.61

|

-5.05% |

222,095

66.94%

|

331,800

|

Most Recent Note for WPZ - 8/11/2011 12:49:43 PM

This MLP rebounded from below its 200 DMA line with gains this week after damaging distributional action. Sales and earnings history (fundamentals) are been below guidelines of the fact-based system.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

We are not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to FactBasedInvesting.com c/o Premium

Member Services 665 S.E. 10 Street, Suite 201

Deerfield Beach, FL 33441-5634 or by calling 954-785-1121.

We appreciate any feedback

members may wish to send via the inquiry form

here.

|

|

|